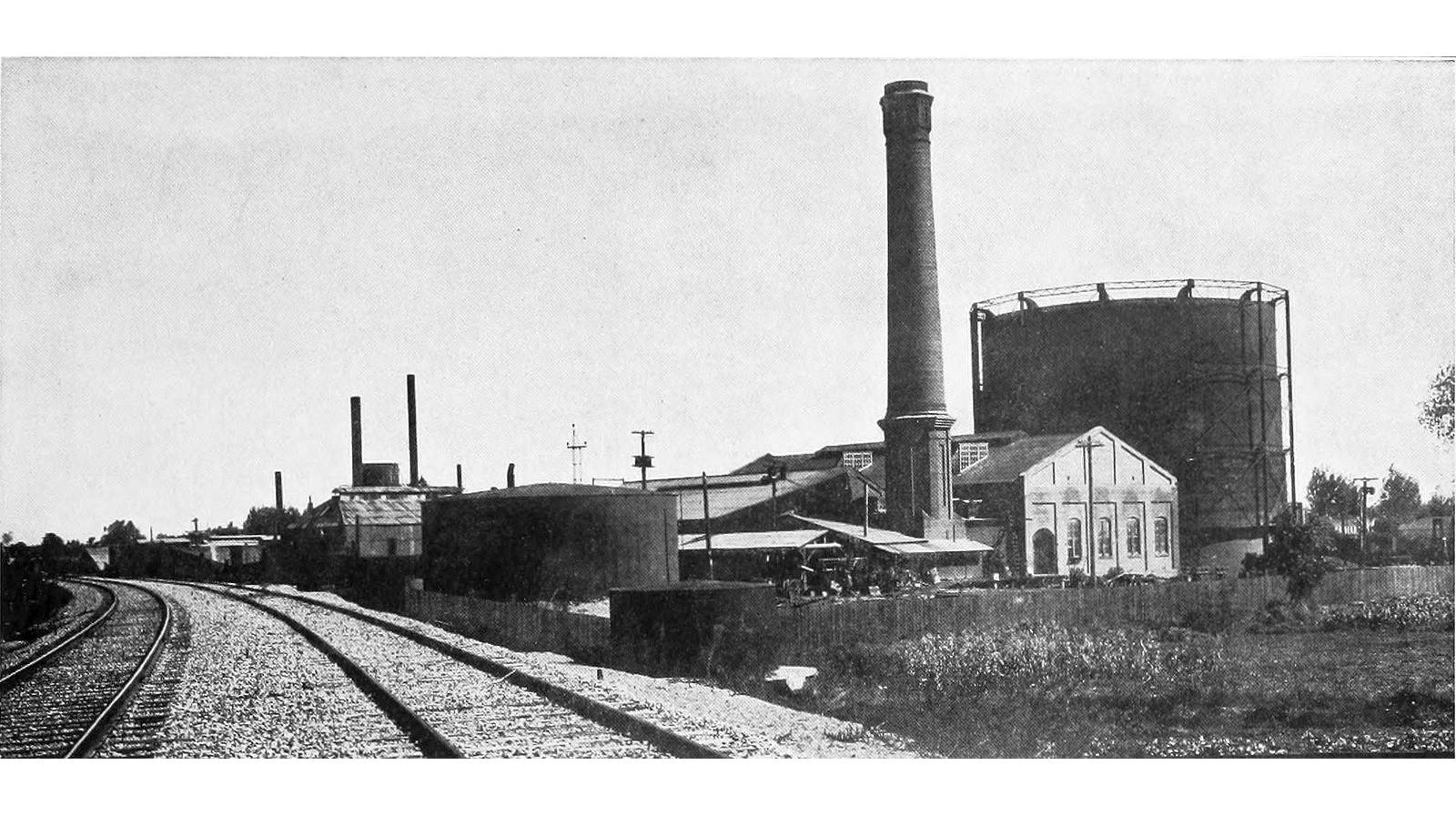

Pacific Gas and Electric Company plant in Sacramento, California, 1912

Publication date: 18-04-2025

Pacific Gas and Electric Company (PG&E) is one of the largest regulated electric and natural gas utilities in the United States, serving over 10 million customers across Northern and Central California. The company plays a critical role in California’s energy infrastructure, with a vast network of electricity transmission and distribution lines, as well as natural gas pipelines

In recent years, PG&E has focused on improving safety and reducing the risk of wildfires through large investments in its infrastructure. These efforts include placing lines underground, upgrading equipment, and improving early warning systems. As a result, the company avoided major wildfire-related losses in the past two seasons and has improved its financial health.

Importantly, the recent wildfires in Southern California occurred outside PG&E’s service area, so they did not directly impact the company. However, there is a potential indirect effect: if other utilities make large claims on the state’s wildfire insurance fund, the remaining capacity of the fund could be reduced. PG&E continues to have access to the fund, but its future strength depends on how the situation develops.

The bond maturing pays a fixed coupon of 6,4% and is issued by PG&E’s core operating company. This bond is backed by the utility’s physical assets, such as infrastructure used to deliver electricity and gas. This provides an added layer of protection for bondholders compared to unsecured bonds.

as of 31.12.2024 USD bn

| Column 1 | Column 2 | Column 3 | Column 4 | Column 5 | Column 6 |

|---|---|---|---|---|---|

| Assets | 133,7 | EBITDA Margin | 35 % | CFO/Debt | 0,1 |

| Revenue | 24,4 | Net debt | 57,1 | FCF | (2,4) |

| EBITDA | 8,6 | Net Debt/EBITDA | 6,6x | Equity | 30,4 |

| Net Profit | 2,5 | EBITDA/Interest | 3x | Debt/Equity | 1,9x |

All data and information is provided “as is” for informational purposes only, and is not intended for trading purposes or financial, investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trade. Bondfish is not an investment adviser, financial adviser or a broker. None of the data and information constitutes investment advice nor an offering, recommendation or solicitation by Bondfish to buy, sell or hold any security or financial product, and Bondfish makes no representation (and has no opinion) regarding the advisability or suitability of any investment. Mention of specific financial products or operations does not constitute an endorsement by Bondfish.

The financial products or operations referred to in such data and information may not be suitable for your investment profile and investment objectives or expectations. It is your responsibility to consider whether any financial product or operation is suitable for you based on your interests, investment objectives, investment horizon and risk appetite. Bondfish shall not be liable for any damages arising from any operations or investments in financial products referred to within. Bondfish does not recommend using the data and information provided as the only basis for making any investment decision.

This data is not updated in real time and represents the prices available at the end of the previous trading day. Bondfish does not verify any data and disclaims any obligation to do so. Bondfish expressly disclaims the accuracy, adequacy, or completeness of any data and shall not be liable for any errors, omissions or other defects therein, delays or interruptions in such data, or for any actions taken in reliance thereon. Bondfish shall not be liable for any damages relating to your use of the information provided herein.

Past performance is not a reliable indicator of future results.