Publication date: 22-08-2025

British American Tobacco (BAT), headquartered in London, is the largest publicly listed tobacco company outside China. Its operations cover over 150 markets, with leadership positions in more than 50. The group’s product portfolio is split between traditional combustibles like cigarettes (still generating the majority of profits and cash flow) and next-generation products (NGP) such as vapour, heated tobacco, and modern oral nicotine. In 2025, new categories account for about 14% of group revenues and may grow up to 25% by 2030.

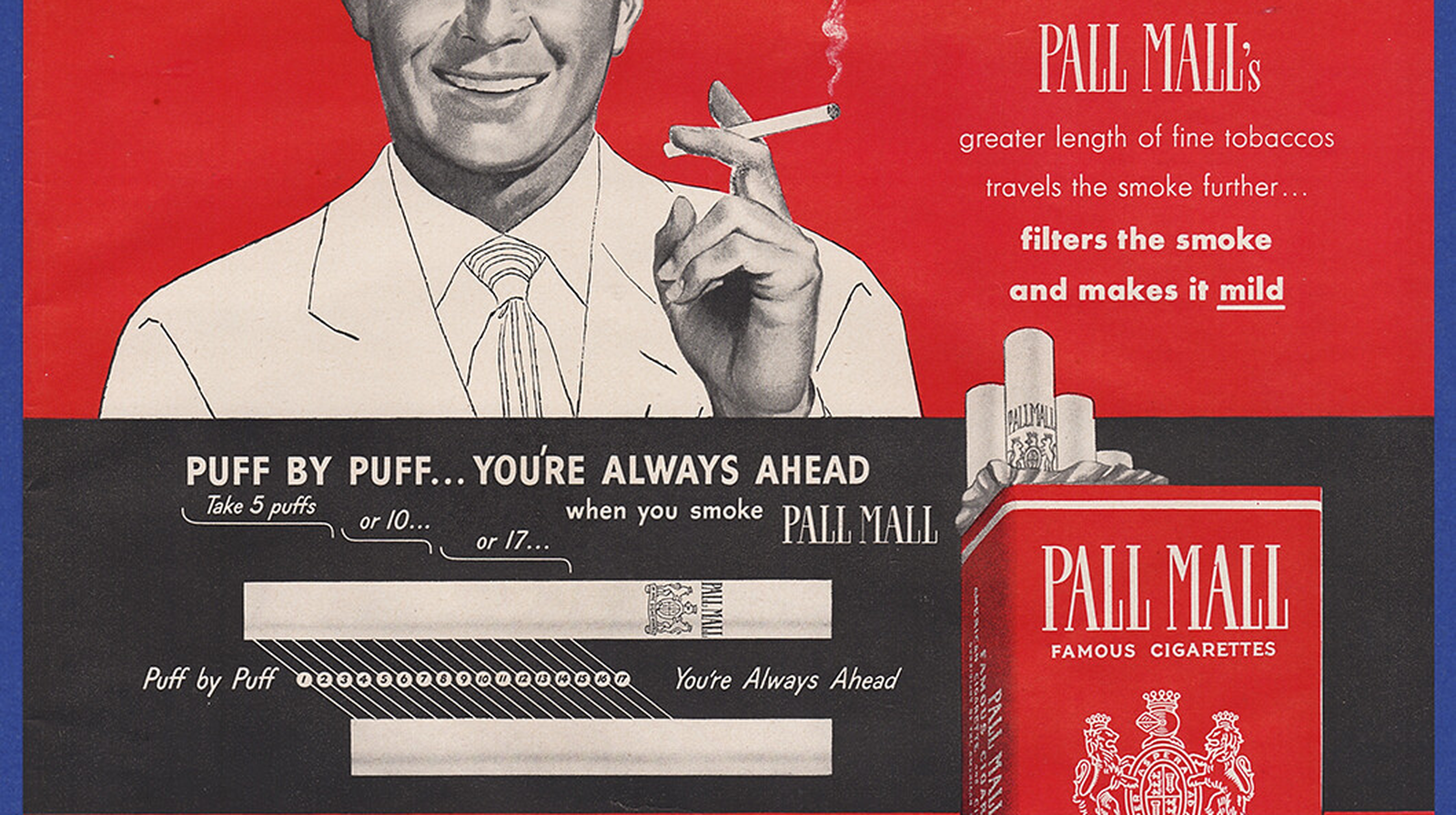

BAT’s competitive strengths come from its strong brands portfolio (Dunhill, Lucky Strike, Pall Mall, Newport in the U.S., and others), its wide distribution network that spans over 150 countries, and its early investment in next-generation products. This allows the company to keep its strong position in traditional cigarettes while expanding into newer, reduced-risk categories.

At the same time, the company faces structural challenges. In its largest market, the U.S., cigarette volumes have been falling at a high single-digit pace — a trend driven by affordability issues, consumer downtrading to discount brands, and competition from alternative nicotine formats. In Europe and Asia-Pacific, performance in heated tobacco and vapour has been pressured by new regulations and excise tax hikes, such as the single-use vape bans implemented in France and the UK in 2025 and higher duties in Australia and Bangladesh.

Financially, BAT is committed to keeping net leverage in a 2,0–2,5x range in 2026. Strong cash flow from its combustible base and growing contributions from NGP profitability support this trajectory.

The 5,375% bond is available for purchase through Interactive Brokers in minimum sizes of €100,000. Investors using Trade Republic can buy much smaller amounts, starting from just €1.

as of 30.06.2025 GBP bn

| Column 1 | Column 2 | Column 3 | Column 4 | Column 5 | Column 6 |

|---|---|---|---|---|---|

| Assets | 118,9 | EBITDA Margin | 55 % | CFO/Debt | 0,2 |

| Revenue | 25,6 | Net debt | 31,1 | FCF | 8,1 |

| EBITDA | 14,1 | Net Debt/EBITDA | 2,2x | Equity | 50,0 |

| Net Profit | 7,9 | EBITDA/Interest | 8x | Debt/Equity | 0,7x |

All data and information is provided “as is” for informational purposes only, and is not intended for trading purposes or financial, investment, tax, legal, accounting or other advice. Please consult your broker or financial representative to verify pricing before executing any trade. Bondfish is not an investment adviser, financial adviser or a broker. None of the data and information constitutes investment advice nor an offering, recommendation or solicitation by Bondfish to buy, sell or hold any security or financial product, and Bondfish makes no representation (and has no opinion) regarding the advisability or suitability of any investment. Mention of specific financial products or operations does not constitute an endorsement by Bondfish.

The financial products or operations referred to in such data and information may not be suitable for your investment profile and investment objectives or expectations. It is your responsibility to consider whether any financial product or operation is suitable for you based on your interests, investment objectives, investment horizon and risk appetite. Bondfish shall not be liable for any damages arising from any operations or investments in financial products referred to within. Bondfish does not recommend using the data and information provided as the only basis for making any investment decision.

This data is not updated in real time and represents the prices available at the end of the previous trading day. Bondfish does not verify any data and disclaims any obligation to do so. Bondfish expressly disclaims the accuracy, adequacy, or completeness of any data and shall not be liable for any errors, omissions or other defects therein, delays or interruptions in such data, or for any actions taken in reliance thereon. Bondfish shall not be liable for any damages relating to your use of the information provided herein.

Past performance is not a reliable indicator of future results.